Capturing Stochastic Volatility: Key to Trading Inflation Derivatives

In the past few years, the markets have witnessed a deepening of liquidity in the inflation derivative markets both in terms of longer maturities being traded and non-ATM strikes becoming far more liquid. A wide range of cap/floor strikes, including those struck at non-zero strikes, are now available with maturity ranging up to 30 years and sometimes even longer. “Modeling the smile and capturing the stochastic nature of volatility has become critically important for inflation derivatives trading,” said James Jockle, Numerix Senior Vice President, during a webinar introducing the models. “The new models help to capture the volatility that standard approaches did not address in the past.”

Historically, the standard for the valuation of inflation rate derivative products was the Jarrow-Yildirim (JY) model. “Historically, volatility and the reversion of real interest rates are not observable. Our new models had to allow for robust calibration. For example, our market models deal with CPI forwards and log-normal dynamics,” according to Dr. Andrei Lopatin, Vice President, Quantitative Research and Development from Numerix.

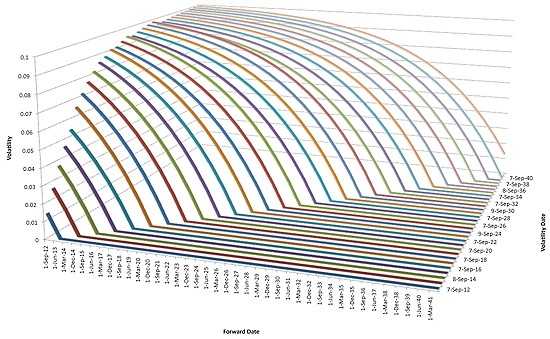

The Numerix Inflation Market Models (IMM) implementation includes three model types: the Standard IMM (Forward CPI rates modeled as lognormal processes), Heston IMM (with Heston/CIR stochastic volatility processes), and SABR IMM (with SABR stochastic volatility processes). In the case of the Heston model, the stochastic volatility was introduced as a multiplier of index volatilities. This is equivalent to making index volatilities stochastic. In the case of the SABR model, Numerix impose stochastic dynamics onto rates volatilities.

“The observation of the volatility surface is one of the great features of the IMM. Other things that make IMM a better approach include de-correlation, stochastic volatility and modeling CPI directly without real rates,” according to Jie Zhu, Senior Financial Engineer during a presentation of the implementation and validation of the models in Numerix.

To learn more about Numerix Inflation Market Models, contact sales@numerix.com.