Mastering FX Derivatives and Hedging Interest Rate Risk in Turbulent Times

Benchmark rate reform has led to structural changes in the financial and capital markets, particularly in the OTC derivatives segment. The direct impact of the reform has been a shift from using LIBOR (interbank term rate) referencing to RFR (risk-free overnight rate) referencing derivative instruments. At the same time and whilst the traded volumes of cross-currency interest rate swaps continue to grow, the associated trade definitions, pricing and risk management of these swaps has become more complex, particularly with MTM (market to market) definitions being standard in major currencies.

Assessing the Risks

Central banks have responded at different speeds and to varying extents to the heightened inflationary era from 2021. More recently, given the varying inflationary expectations between economies, there is a lack of alignment between central banks on whether and when to cut rates. This uncertainty is resulting in greater volatility in the forward FX and cross currency swap markets.

This year, following an era of rate hikes and peaking rates, the timeline for normalization of rates between the US and the Eurozone is in opposition. Whilst the ECB is expected to begin monetary easing, the market’s expectations for the FED to follow with several rate cuts have changed, and the market is now pricing just one potential rate cut towards the end of the year. The view expressed by economists aligns with this expectation for the US. Some economists even predict a potential US rate hike to tame the sticky inflation ("the last mile of inflation getting it back to 2%"), so while there are likelihoods, nothing is certain.

The impact of the diverging or delayed rate trajectories has dampened the economic outlook. Some anticipate that a lower ECB rate will result in outflows from the EUR into USD, and a weaker projected EUR, akin to what happened in 2022 when the ECB lagged the FED in shifting its monetary policy position. This would lower financing costs for businesses operating within the Eurozone, and a depreciated euro makes for attractive exports. What is unclear is how and whether higher importing costs against a strong USD would in balance have a more harmful impact for the Eurozone economy, particularly with respect to passing on inflation via higher pricing.

Prior to 2022, central banks rates were historically low, particularly in the Eurozone, where the ECB effectively set the rate at 0% from 2013-2022. There is some likelihood that the ECB's delayed response reflected a fragile economic outlook, where the market had grown accustomed to funding itself at ultra-low rates. As seen with Brexit, sentiment can have a substantial impact on FX rates and markets tend to correct very quickly. This is another source of risk, particularly in the Eurozone.

Hedging and Accuracy

The above makes a strong case for rates and FX hedging. The need to hedge FX exposure has been long established as essential and even so in a more predictable market environment. Anticipated changes in monetary policy decisions impact the FX forward and broader FX derivatives markets directly, with a greater awareness on both the advantages and costs of hedging - and not to mention the need to accurately value and perform hedge effectiveness testing for outstanding volumes. The current uncertain environment brings these requirements into focus.

In pricing FX derivatives, such as FX forwards and cross-currency basis swaps, building local market curves and being able to project FX rates are essential for accurate valuation. Furthermore, when derivatives involve collateral agreements across multiple currencies or netting agreements, the optimization and reflection of collateralization necessitates specific curve-building requirements.

With ultra-low rates, the derivatives market also became accustomed to swap leg values at a significantly lower scale than what we are seeing today with rates in the 4-5% range. Further, for cross-currency basis swaps, projected MTM notional adjustments have become more significant and more sensitive to rate policy setting. This brings a stronger focus on accuracy in performing valuations.

Simplifying Curve-building, Valuation, and Risk Analysis

FINCAD Analytics Suite is a powerful, flexible tool that supports the evolving needs of FX derivatives. Key solution highlights include:

- Differentiated curve building capabilities to address RFR requirements, incorporating central bank meeting date schedules and rate turn pressure, as well as flexible cross currency curves, from FX-adjusted curves to cross-currency basis curves that apply FX forwards and cross-currency basis swap instrument quotes

- Flexible FX curve adjustments for a variety of approaches to project FX-adjusted curves and reflect CTD collateral agreements

- Support for broad range of instrument types, out of the box capabilities in FX forwards and cross-currency basis swaps, for pricing, risk and cashflow analysis

- Ability to define customized workflows, easy to extend analytics to include intermediate results such as curve or market data scenario analysis, forward valuation scenario analysis and forward par grid analysis

- Scalable solution, user-friendly SDK scales to larger volume and more complexly defined portfolios, and performing more advanced analytics workflows such as risk bucketing, key rate duration and scenario analysis. For many, FINCAD Analytics Suite is a calculation engine, integrated into highly performative applications and processes, extending naturally to time series analysis such as back testing, which can be extended to applying statistical analysis in performing hedge effectiveness testing.

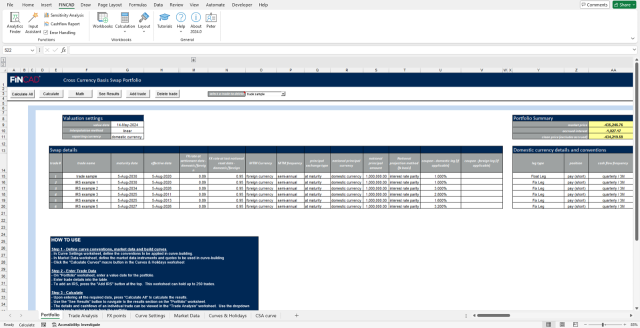

Cross currency basis swap portfolio product workbook

FINCAD Analytics Suite from Numerix elegantly handles complex and customized cross currency basis and currency swap structures, such as fixed-to-floating, fixed-to-fixed, amortizing, accreting, step-up and basis swaps with the confidence that the range of market conventions are accounted for, such as stub types, compounding definition of referenced rate, compounding of cashflows, as well as payment delay, lockout, lookback and associated observation shift types, with LIBOR Fallback Scenario support. Evaluating the fair value, sensitivity, and risk profile of swaps, and performing scenario analysis, stress testing, and hedge effectiveness assessment are all simplified using the solution. Plus, FINCAD Analytics Suite empowers investors to measure and manage their exposure to counterparty credit risk and collateral requirements.

FREE Trial: FINCAD Analytics Suite

Would you like to begin gaining deeper insight into hedging with rates and FX derivatives? Get started today. We’d like to extend you the opportunity to try FINCAD Analytics Suite for Excel free for 14 days. Experience how easy it is to build curves and value and risk manage forwards and swaps in a consistent and reliable way using our award-winning analytics library.