Structure, price and manage any type of derivative or structured product

Numerix CrossAsset offers the industry’s most comprehensive derivatives pricing and risk management analytics library to empower users to structure, price and manage even the most complex OTC derivatives with ease.

In addition to its wide array of pricing models and adaptable architecture for defining bespoke deals, CrossAsset enables users to deploy a unified pricing and risk management solution for all your exotic derivative and fixed income positions across all trade types.

Capabilities

Comprehensive CrossAsset Library

The award-winning CrossAsset derivative pricing and risk analytics library sets the benchmark for the pricing and risk management of exotic derivatives. It offers the industry’s most comprehensive cross-asset class library of market-standard models and advanced numerical methods. Whether you're valuing a vanilla option using our extensive collection of pre-defined templates and closed-form pricers, or creating a bespoke instrument with our unique payoff scripting language or Python, CrossAsset enhances the efficiency and precision of derivative pricing, valuation, and risk management to unparalleled levels.

Built for continually evolving capital markets

Numerix CrossAsset empowers end-users to perform pricing and risk calculations on any derivative at runtime, eliminating the need for recompilation or redistribution. This "data-driven" ensures CrossAsset remains at the forefront of the rapidly evolving field of derivative pricing.

Recognized leader in pricing and risk analytics for exotic derivatives and complex hybrid derivatives

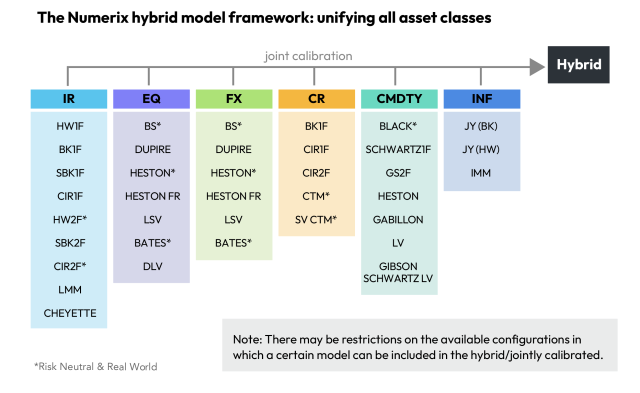

Numerix's hybrid model framework produces accurate valuations for complex instruments composed of multiple underlyings through joint calibration and incorporating of multiple stochastic processes.

Advance risk capabilities

Risk scenario framework

Numerix Risk Scenario Framework automates the modeling and pricing of portfolios of non-loan securities and derivatives held by operations, such as treasury departments and investment banking subsidiaries—specifically for structuring custom greeks and stress tests.

Numerix uses this stress testing framework to automate the estimation of portfolio value changes, gains, and losses across various scenarios required for stress testing by financial institutions. Integrated with a financial institution's book of records, the Risk Scenario Framework conducts scenario-based analyses and projections for all positions within the firm.

Scenario Analysis

Numerix's Risk Scenario Framework enhances stress testing capabilities, enabling the calculation of central difference Greek sensitivities like Interest Rate DV01, equity delta, and vega, while also supporting large-scale scenario shocks.

Key features include:

- Calculation of Greeks and sensitivities across asset classes in any market data environment.

- Customizable reports with user-defined statistics for consistent calculation across single or multiple asset classes.

- Aggregation of Greeks by asset class.

- Creation of bespoke market scenarios, as well as risk and P/L decomposition reports.

Flexible deployment

From trading desk to enterprise risk management — CrossAsset easily integrates within your operations

CrossAsset XL

Numerix CrossAsset XL offers unparalleled flexibility for structuring, pricing, and managing complex derivatives and structured products—all within the familiar Microsoft© Excel environment used by traders and structurers.

Key features include:

Single asset class or a complete cross-asset solution

Available as a comprehensive cross-asset solution or modular modules tailored to specific asset classes.

Make better trading decisions

CrossAsset XL facilitates pre-trade price discovery and enables stress-testing and monitoring of trading strategies directly in Excel. This helps users develop more informed trading strategies and better trading decisions.

Design for continually evolving capital markets

Rapidly describe any new deal type using hundreds of customizable trade templates, an intuitive payoff scripting language and the industry’s most comprehensive cross-asset class pricing and risk analytics library to dramatically reduce time-to-market for creating new products.

CrossAsset SDK

The CrossAsset Software Development Kit (SDK) is available in Python, Java, C#, and C++, allowing seamless integration of Numerix’s top-tier pricing and risk analytics library into proprietary or third-party software/systems. This empowers users across trading and risk management functions to achieve consistent analytics firm-wide.

Key features include:

Simplify the process of developing custom applications

Integrate our comprehensive derivatives pricing and risk management analytics library seamlessly into your core system to effortlessly produce valuations, Greeks, cash flows, and scenarios. Our low-level interface also enables detailed customization of bespoke applications to meet specific needs at a granular level

Scalability

Users can effortlessly deploy their solution on-premises or on cloud computing platforms, enabling seamless scaling of large, complex portfolio-level calculations for valuations and risk using cloud resources.

Path to Standardization

The CrossAsset SDK paves the way toward achieving a unified "single-source of truth" system for structuring, pricing, and risk management of derivatives and structured products, including hard to price exotic derivatives.

Numerix Economic Scenario Generator

The Numerix Economic Scenario Generator (ESG) is a powerful stochastic simulation framework that enables financial institutions to generate both risk-neutral and real-world economic scenarios, supporting comprehensive financial modeling, risk management, and regulatory compliance.

Key features include:

Comprehensive model library

Access 40+ capital market models across asset classes, including the Libor Market Model (LMM) and Credit Transition Models (CTM).

Unmatched flexibility

Full visibility and customization of model settings for tailored scenario generation.

Custom scenario scripting

Create custom indices and generate tailored scenarios to enhance innovation and accelerate time-to-market.

Hybrid model framework

Accurately model correlated markets and asset dynamics for complex, multi-asset products.

API integration

Seamlessly integrate with systems using multiple APIs, including Excel, Python, and Java.

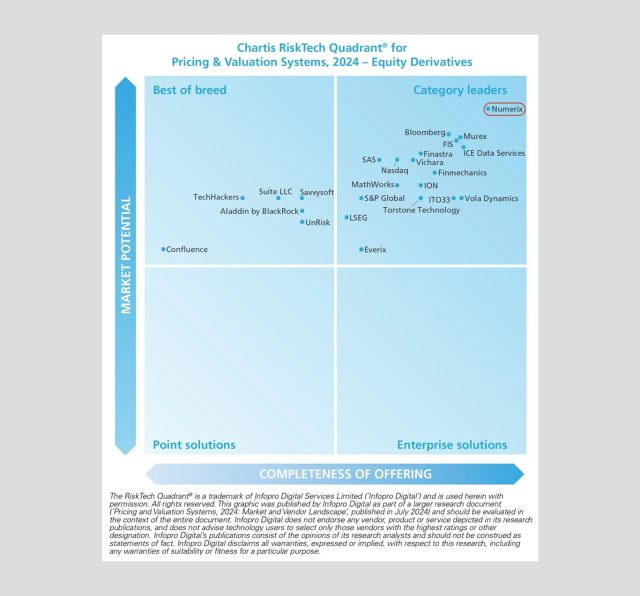

Numerix named a leader

In the 2024 Chartis Research RiskTech Quadrant® for Pricing and Valuation Systems, 2024 – Equity Derivatives

Capital markets awards that speak for themselves

Want to see CrossAsset in action?