Integrating accounting and income simulation with market value economics and risk

PolyPaths ALM unifies accounting and income simulation with market value economics and risk. It extends the analytics of PolyPaths Trading & Risk Management to tackle the complexities of balance sheet management with a focus on modeling, transparency, flexibility, and productivity. By bridging the gap between portfolio economics and accounting, ALM transforms the way assets and liabilities are calculated and reported, thereby improving risk measurement and decision making.

PolyPath ALM puts income simulation across a variety of different asset and liability classes and accounting treatment in the hands of the decisions makers – whether it’s at the corporate level, within a specific division or unit, or at an individual level. Users have the flexibility to modify any component – be it accounting, products, funding, hedging, balance sheet objectives, cash management, or risk targets – and obtain results in mere minutes. PolyPaths ALM is utilized across teams for portfolio and risk management, earnings and financial planning, regulatory stress testing, counterparty exposure, and model validation, making it an essential tool for business users.

Capabilities

Modify accounting treatments and view the resulting reports

Users are able to modify accounting treatments on the fly and view the resulting reports in just minutes. It also supports a variety of GAAP accounting treatments, all of which can be selectively applied and viewed on a single screen. Moreover, it is also able to generate standard reports for Balance Sheet, Market Value, Book Income, Cash Flows and Risk as well as reports for FAS hedge relationships and transaction reports on funding, hedges, and user-defined relationships.

Flexible limits and rules

Users are empowered with the flexibility to tailor limits and rules, to ensure compliance with internal policies and regulations. These rules, adaptable to specific strategies or scenarios, can also be dynamically adjusted in response to market conditions and simulation results. It also supports robust optimization for a wide range of constraints (asset allocation, funding, hedging, portfolio construction, and single, user-defined, or stochastic scenarios) in all facets of portfolio analysis and bank asset/liability management.

Comprehensive coverage and capabilities

PolyPath ALM is able to handle the full suite of fixed income products and dynamic new products across different time, scenario and strategies. It also covers the reinvestment of principal and interest cash flows to generate reinvestment interest.

Automated ALM process

PolyPaths ALM offers a user-friendly Excel interface for running income simulations. The entire ALM process and reporting can also be automated, allowing PolyPaths ALM to fit seamlessly within a client’s overall workflow. PolyPath ALM also separates instrument-level calculations from simulation calculations for faster run times hence it is able to run the accounting, aggregation and reporting in minutes

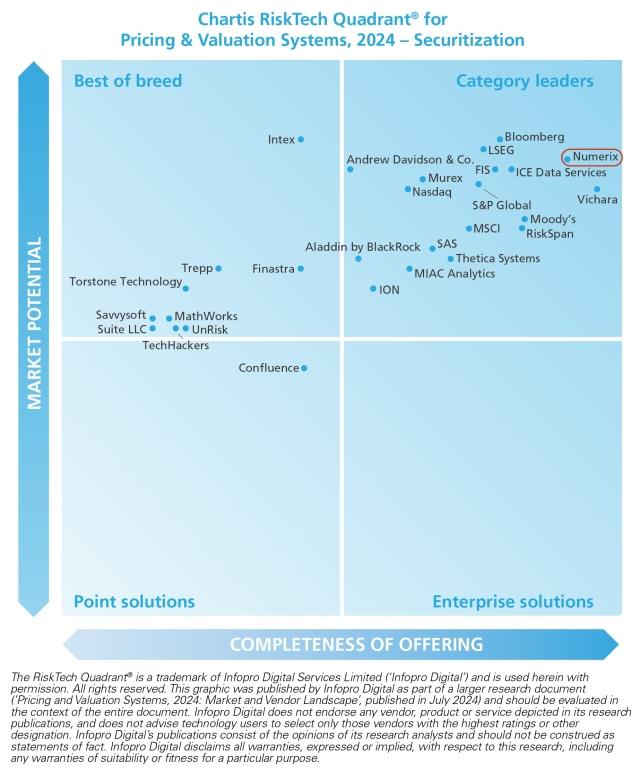

Numerix named a leader

In the 2024 Chartis Research RiskTech Quadrant® for Pricing and Valuation Systems, 2024 – Securitization

Capital markets awards that speak for themselves

Product factsheet

PolyPath’s Asset Liability Management

Discover how PolyPaths ALM seamlessly integrates accounting and income simulation with market value economics and risk, enhancing both risk measurement and decision-making.

Want to see PolyPaths ALM in action?